Last September, then vice-presidential candidate JD Vance proclaimed in a Pennsylvanian supermarket, “Eggs, when Kamala Harris took office, were short of $1.50 a dozen. Now a dozen eggs will cost you around $4.” The implication was clear—the Biden Administration’s policies allegedly caused egg prices to skyrocket. While Vance was mocked at the time for the contradiction between his statement and the dozen eggs on sale for $2.99 behind him, to the chagrin of his critics, we now know that inflationary conditions, regardless of the cause, may have been a key factor that brought right-wing populism back to the White House.

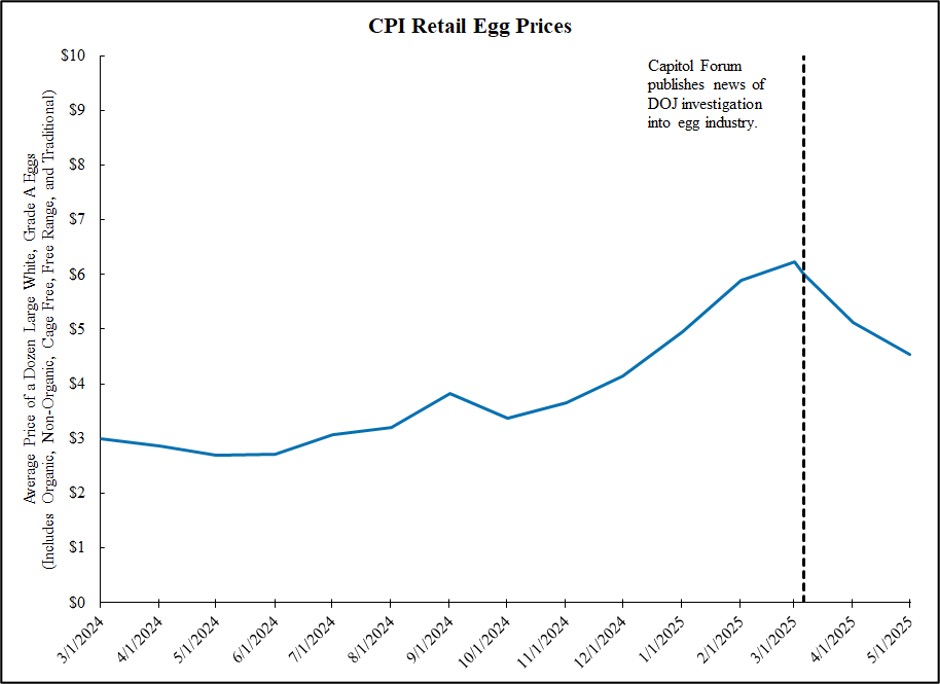

Despite the contemporaneous criticism of Vance’s statement, his critique highlighted a key vulnerability for Democrats. According to the Bureau of Labor Statistics (BLS), the average retail price of a dozen eggs was $1.46 in January 2020 when former President Biden took office. Through late 2022 to early 2023 and then again in late 2023 to early 2025, egg prices experienced two separate price spikes. For the latter episode, retail prices reached $3.82 in September 2024 (up 85 percent from the previous September) and then continued to soar to an all-time high of $6.23 in March 2025 (more than double the prices from the previous March).

The mainstream media, egged on by egg industry lobbyists, pointed to a one main culprit—the bird flu. Certainly, the mass culling of hens to prevent viral spread decreased egg supply, putting upward pressure on prices. In February of this year, USDA Chief Economist Seth Meyer stated that the United States had about 291 million egg-laying birds compared to a normal flock size of 320 to 325 million (roughly a nine percent decline). From an economic perspective, it is unremarkable that a sudden and economically significant supply-side shock would cause a price increase for an inelastic good. Yet bird flu may just be one part of the story.

There May Be Some Rotten Eggs

In a January 2025 letter to the Trump Administration, Senator Elizabeth Warren called for increased efforts by the Department of Justice (DOJ) and Federal Trade Commission (FTC) to investigate and curtail anticompetitive activity in the agricultural sector, pointing, in part, to the behavior of Cal-Maine, the nation’s largest egg producer. Democrats in Congress continued their advocacy for investigations through February. Then in February and March, reports by Farm Action and Food & Water Watch used empirical analysis to cast doubt on the story that bird flu alone caused the explosion in egg prices. These reports provide evidence that bird flu’s impact on total egg production has been relatively minor.

For instance, Farm Action found that monthly egg production since 2021 (the year before the bird flu epidemic) were only down three to five percent on average. These reports specifically highlight the role of Cal-Maine, producing 21 percent of domestic egg consumption, for its conduct in actively consolidating the egg industry. This period of elevated prices has been hugely beneficial to the egg producers with major egg firm, like Cal-Maine, seeing their profits triple to octuple.

One potential cause for the inflated prices may have something to do with the conduct of chicken hatcheries—that is, the firms that supply egg companies their chickens. Antitrust attorney Basel Musharbash explains that typically there is an increase in demand for replacement chicken following “Fowl Plagues.” For this crisis, however, hatcheries appeared to have reduced the quantity of hens supplied to these egg producers. And no, this does not seem to be a consequence of the bird flu affecting these hatcheries, with only 123,000 breeder hens culled since 2022 (representing merely three to four percent of the U.S. breeder flock at any given time). As Musharbash explains, this quantity decrease is likely a strategic decision by the two companies, Erich Wesjohann Group and Hendrix Genetics, that form the duopoly that controls the production of new egg-laying hens. This lack of competition may lead to higher prices which have pass through to consumers.

In contrast to the hatcheries that supplies them chickens, the egg industry itself is far from being concentrated by traditional antitrust standards. This industry structure suggests that, absent price coordination, egg prices should reflect competitive levels or something approaching marginal costs. Using data from Egg Industry’s Top Egg Company Survey, we can provide a rough estimate of the Herfindahl-Hirschman Index (HHI) for the industry. Based on the end-of-year egg laying flock size of the top 52 largest U.S. egg producers, and assuming no overlapping ownership interests, the HHI for the egg industry in 2024 was approximately equal to 480. This measure is well below the 1,000 threshold that the DOJ and FTC view as indicating a concentrated industry. HHI does not always tell the whole story, however, and with the top five largest egg producers representing nearly half the industry, the conditions are ripe for collusion.

After all, if something suspect is occurring with prices, it would not be the first time for the egg industry. Back in 2023, a jury held Cal-Maine and other egg producers liable for participating in a price-fixing scheme running from 1999 to 2008, forcing egg producers to pay $53 million in damages. Defendants in that case used a trade organization, named United Egg Producers, to run a hub-and-spoke conspiracy to set-egg prices among major egg producing chains in America. Once companies get used to colluding among themselves, it is often a hard habit for them to break. In addition to lingering coordinated conduct, there could also be nefarious unilateral conduct: Cal-Maine was sued by the state of Texas for allegedly price gouging during the Covid-19 pandemic. This history is rarely mentioned in media coverage explaining egg prices, even when factors other than bird flu are mentioned. (Examples of other cited factors include fuel and feed costs, often times without noting that both have decreased or remained stable in the past year.)

Behold the Bully Pulpit

On March 6, Capitol Forum broke a major story that the DOJ was actively investigating several egg producers, including Cal-Maine, for leading a potential price-fixing conspiracy. As Capitol Forum elaborated earlier this week, the investigates appears to be centering on Expana (formerly Urner Barry), which produces the egg industry’s primary pricing index. Farm Action found almost all egg prices are based off Expana’s indices. Indeed, when Cal-Maine CEO asserts that the company has little control over prices and instead sets prices based on a “benchmark price for eggs,” he is likely referring to an Expana index. Benchmarking companies, such as Expana, have been increasingly put under the spotlight for how they can facilitate collusion. For instance, the benchmarking firm Agri Stats allegedly facilitated collusion among poultry processing companies (the case settled for $169 million).

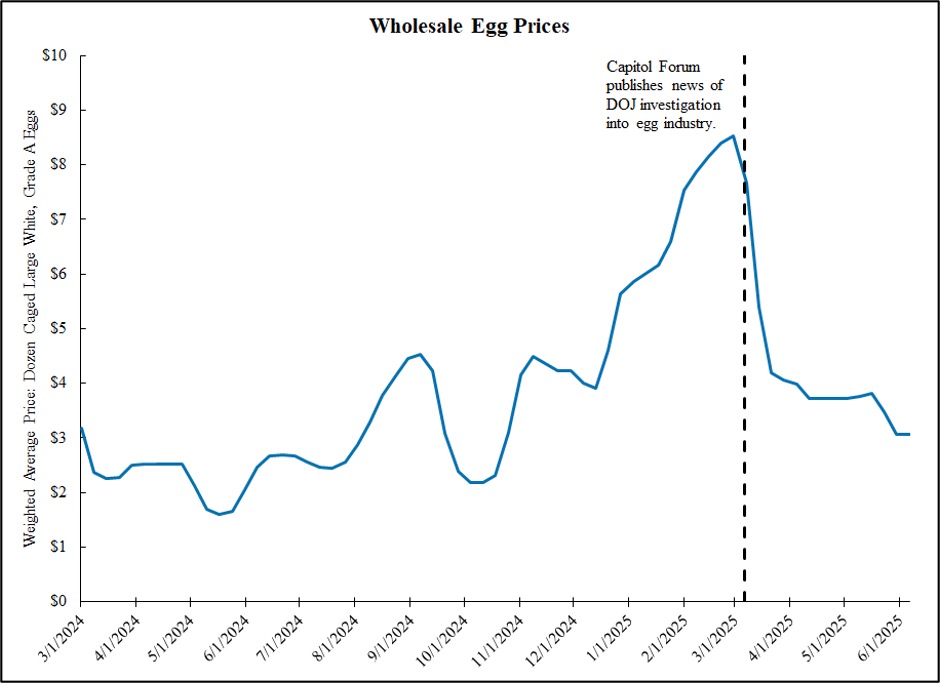

As one of us touched on in a piece last month, the pricing impact of this DOJ inquiry was potentially significant. The figure below shows how news of the investigation corresponded to a dramatic collapse in wholesale egg prices. On March 5, the average cost of a dozen large white eggs was $8.12. Just two weeks after the March 6 Capitol Forum story, on March 19, those same eggs cost $3.03—a 62.7 percent decrease.

Source: USDA Weekly Combined Regional Shell Egg Report. Data from the Biden Administration available here. Note: Caged large white, Grade A eggs account for roughly half of total egg production in the United States.

While retail egg prices lag behind their wholesale benchmark, retail prices also have started to tick down shortly after the Capitol Forum report.

Source: BLS retrieved from FRED.

That there is an inflection at roughly the same time as the announced DOJ investigation does not, by itself, prove a causal impact on prices. As a prominent instance of a confounding variable, the threat of bird flu also diminished around the same time, with only 2.1 million birds affected in March compared to 23 million in January and about 13 million in February. This diminished threat of bird flu undoubtedly weakened supply-side pressures on prices. According to the libertarian Cato Institute, which struggles to conceive of any problem being caused by bad actors, the diminished threat of bird flu may explain most or all of the price decline. Simultaneously, the United States also sought to increase its egg imports to push down prices.

Despite these other factors, it is striking how precisely news of the DOJ investigation coincides with the drop in wholesale prices. Hence, it is reasonable to infer that the initiation of this DOJ investigation may have altered the pricing behavior of major egg producers. After all, the first rule of any conspiracy is to stop conspiring while under the microscope of an investigation.

Indeed, the history of DOJ investigations contributing to price declines seems to make this potential causality more plausible. For instance, during the FDR administration, a massive increase in antitrust enforcement meant that the mere launching of an antitrust investigation by the DOJ corresponded with a 18 to 33 percent reduction in prices in the industry under investigation. Famously, the use of the bully pulpit by JFK also reversed massive steel price hikes in 1962. Though we note that the impacts of JFK’s approach are not without its critics.

Lessons for Enforcement

As one of us wrote last month, pursuing antitrust claims in court might by itself be insufficient to combat the degree of price-gouging, common pricing algorithms, and surveillance pricing that we have witnessed recently. Furthermore, just as bad actors took advantage of the Covid-19 pandemic to artificially inflate their prices, the economic instability generally (and tariffs in particular) inflicted by the Trump Administration may provide similar cover for further price gouging. Yet the DOJ inquiry into egg prices demonstrates that there may be another way forward. Criminal activity thrives when it is in the dark. Just as street lamps deter night time crime, proactive DOJ investigations can highlight, and therefore deter, anticompetitive activity. In our work in a myriad of price-fixing cases, we have often seen firsthand how scrutiny by authorities is the straw that breaks the cartel’s back.

This finding suggests more investigations are needed. Yet we need to deviate from our haphazard system where issues like egg prices are investigated due to heavy news coverage while less politically flashy topics, like the explosion in the price of car insurance, are left to the wayside. According to Einer Elhauge of Harvard Law School, FDR had particular success in his antitrust crusade of the 1940s by making enforcement far more “systematic and focused.” The signal of potential anticompetitive activity that rapidly exploding prices send should be front of mind for our antitrust authorities.

To make enforcement more proactive, we reiterate the call for the DOJ and FTC to adopt formal rules outlining automatic investigation criteria in the wake of rapidly increasing prices. For instance, the DOJ could automatically investigate firms in industries where inflation exceeded some multiple (say two to three times) of the general CPI, particularly if an increase in gross profit margins accompanied this price inflation. (Note that Cal-Maine now earns margins of 70 to 145 percent for a dozen eggs.) Such a rule would not only likely catch more cartels in the act, but it would also serve as a deterrent for companies engaging in this behavior in the first place. Of course, the DOJ and FTC need sufficient funding (and staffing!) to rigorously enforce this proposed rule. We note, and strongly advise against, the Trump Administration considerations of the disastrous idea of shrinking the DOJ Antitrust Division, including possibly closing down field offices focused on the agricultural sector.

Whatever the details of a specific rule, this much is clear: It is time we expand our toolkit to tamp down inflationary pressures arising from novel forms of coordinated pricing. The historical evidence and our recent experience with egg prices demonstrate that automatic DOJ investigations may be one way to get more serious about tackling inflation.

Disclosure: Hal Singer served as an economic expert on behalf of plaintiffs in two cases concerning Agri Stats: Pork Antitrust Litigation, No. 0:18-cv-01776 (D. Minn.) and Broiler Chicken Growing Antitrust Litigation (No. II), 6:20-MD-02977-RJS-CMR (E.D. Ok Aug. 19, 2021).