The Justice Department’s pending antitrust case against Google, in which the search giant is accused of illegally monopolizing the market for online search and related advertising, revealed the nature and extent of a revenue sharing agreement (“RSA”) between Google and Apple. Pursuant to the RSA, Apple gets 36 percent of advertising revenue from Google searches by Apple users—a figure that reached $20 billion in 2022. The RSA has not been investigated in the EU. This essay briefly recaps the EU law on remedies and explains why choice screens, the EU’s preferred approach, are the wrong remedy focused on the wrong problem. Restoring effective competition in search and related advertising requires (1) the dissolution of the RSA, (2) the fostering of suppressed publishers and independent advertisers, and (3) the use of an access remedy for competing search-engine-results providers.

EU Law on Remedies

EU law requires remedies to “bring infringements and their effects to an end.” In Commercial Solvents, the Commission power was held to “include an order to do certain acts or provide certain advantages which have been wrongfully withheld.”

The Commission team that dealt with the Microsoft case noted that a risk with righting a prohibition of the infringement was that “[i]n many cases, especially in network industries, the infringer could continue to reap the benefits of a past violation to the detriment of consumers. This is what remedies are intended to avoid.” An effective remedy puts the competitive position back as it was before the harm occurred, which requires three elements. First, the abusive conduct must be prohibited. Second, the harmful consequences must be eliminated. For example, in Lithuanian Railways, the railway tracks that had been taken away were required to be restored, restoring the pre-conduct competitive position. Third, the remedy must prevent repetition of the same conduct or conduct having an “equivalent effect.” The two main remedies are divestiture and prohibition orders.

The RSA Is Both a Horizontal and a Vertical Arrangement

In the 2017 Google Search (Shopping) case, Google was found to have abused its dominant position in search. In the DOJ’s pending search case, Google is also accused of monopolizing the market for search. In addition to revealing the contours of the RSA, the case revealed a broader coordination between Google and Apple. For example, discovery revealed there are monthly CEO-to-CEO meetings where the “vision is that we work as if we are one company.” Thus, the RSA serves as much more than a “default” setting—it is effectively an agreement not to compete.

Under the RSA, Apple gets a substantial cut of the revenue from searches by Apple users. Apple is paid to promote Google Search, with the payment funded by income generated from the sale of ads to Apple’s wealthy user base. That user base has higher disposable income than Android users, which makes it highly attractive to those advertising and selling products. Ads to Apple users are thought to generate 50 percent of ad spend but account for only 20 percent of all mobile users.

Compared to Apple’s other revenue sources, the scale of the payments made to Apple under the RSA is significant. It generates $20 billion in almost pure profit for Apple, which accounts for 15 to 20 percent of Apple’s net income. A payment this large and under this circumstance creates several incentives for Apple to cement Google’s dominance in search:

- Apple is incentivized to promote Google Search. This encompasses a form of product placement through which Apple is paid to promote and display Google’s search bar prominently on its products as the default. As promotion and display is itself a form of abuse, the treatment provides a discriminatory advantage to Google.

- Apple is incentivized to promote Google’s sales of search ads. To increase its own income, Apple has an incentive to ensure that Google Search ads are more successful than rival online ads in attracting advertisers. Because advertisers’ main concern is their return on their advertising spend, Google’s Search ads need to generate a higher return on advertising investment than rival online publishers.

- Apple is incentivized to introduce ad blockers. This is one of a series of interlocking steps in a staircase of abuses that block any player (other than Google) from using data derived from Apple users. Blocking the use of Apple user data by others increases the value of Google’s Search ads and Apple’s income from Apple’s high-end customers.

- Apple is incentivized to block third-party cookies and the advertising ID. This change was made in its Intelligent Tracking Prevention browser update in 2017 and in its App Tracking Transparency pop-up prompt update in 2020. Each step further limits the data available to competitors and drives ad revenue to Google search ads.

- Apple has a disincentive to build a competing search engine or allow other browsers on its devices to link to competing search engines or the Open Web. This is because the Open Web acts as a channel for advertising in competition with Google.

- Apple has a disincentive to invest in its browser engine (WebKit). This would allow users of the Open Web to see the latest videos and interesting formats for ads on websites. Apple sets the baseline for the web and underinvests in Safari to that end, preventing rival browsers such as Mozilla from installing its full Firefox Browser on Apple devices.

The RSA also gives Google an incentive to support Apple’s dominance in top end or “performance smartphones,” and to limit Android smartphone features, functions and prices in competition with Apple. In its Android Decision, the EU Commission found significant price differences between Google Android and iOS devices, while Google Search is the single largest source of traffic from iPhone users for over a decade.

Indeed, the Department of Justice pleadings in USA v. Apple show how Apple has sought to monopolize the market for performance smartphones via legal restrictions on app stores and by limiting technical interoperability between Apple’s system and others. The complaint lists Apple’s restrictions on messaging apps, smartwatches, and payments systems. However, it overlooks the restrictions on app stores from using Apple users’ data and how it sets the baseline for interoperating with the Open Web.

It is often thought that Apple is a devices business. On the contrary, the size of its RSA with Google means Apple’s business, in part, depends on income from advertising by Google using Apple’s user data. In reality, Apple is a data-harvesting business, and it has delegated the execution to Google’s ads system. Meanwhile, its own ads business is projected to rise to $13.7 billion by 2027. As such, the RSA deserves very close scrutiny in USA v. Apple, as it is an agreement between two companies operating in the same industry.

The Failures of Choice Screens

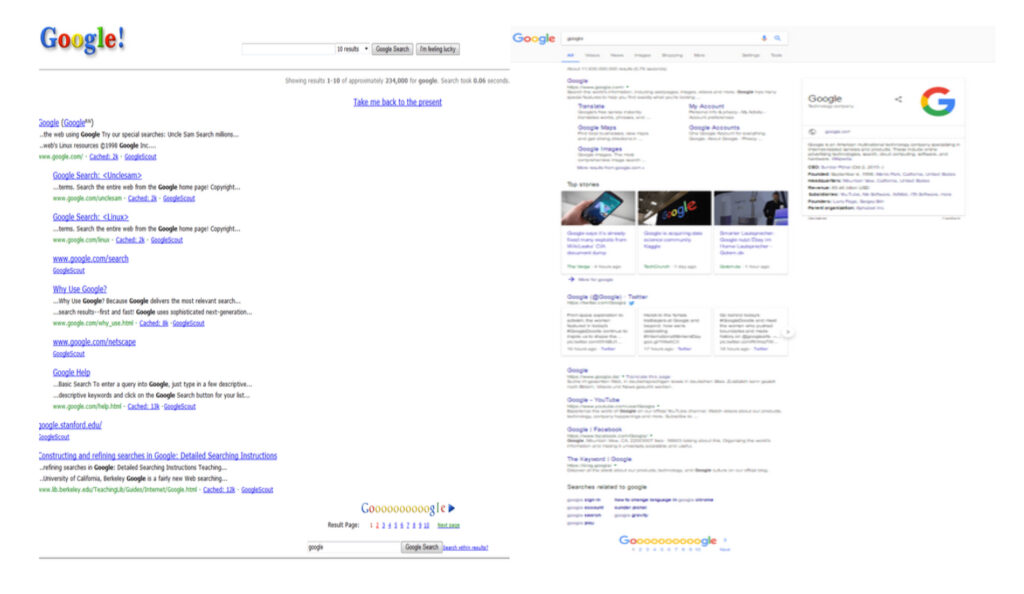

The EU Google (Search) abuse consisted in Google’s “positioning and display” of its own products over those of rivals on the results pages. Google’s underlying system is one that is optimized for promoting results by relevance to user query using a system based on Page Rank. It follows that promoting owned products over more relevant rivals requires work and effort. The Google Search Decision describes this abuse as being carried out by applying a relevance algorithm to determine ranking on the search engine results pages (“SERPs”). However, the algorithm did not apply to Google’s own products. As the figure below shows, Google’s SERP has over time filled up with own products and ads.

To remedy the abuse, the Decision compelled Google to adopt a “Choice Screen.” Yet this isn’t an obvious remedy to the impact on competitors that have been suppressed, out of sight and mind, for many years. The choice screen has a history in EU Commission decisions.

In 2009, the EU Commission identified the abuse Microsoft’s tying of its web browser to its Windows software. Other browsers were not shown to end users as alternatives. The basic lack of visibility of alternatives was the problem facing the end user and a choice screen was superficially attractive as a remedy, but it was not tested for efficacy. As Megan Grey observed in Tech Policy Press, “First, the Microsoft choice screen probably was irrelevant, given that no one noticed it was defunct for 14 months due to a software bug (Feb. 2011 through July 2012).” The Microsoft case is thus a very questionable precedent.

In its Google Android case, the European Commission found Google acted anticompetitively by tying Google Search and Google Chrome to other services and devices and required a choice screen presenting different options for browsers. It too has been shown to be ineffective. A CMA Report (2020) also identified failures in design choices and recognized that display and brand recognition are key factors to test for choice screen effectiveness.

Giving consumers a choice ought to be one of the most effective ways to remedy a reduction of choice. But a choice screen doesn’t provide choice of presentation and display of products in SERPs. Presentations are dependent on user interactions with pages. And Google’s knowledge of your search history, as well as your interactions with its products and pages, means it presents its pages in an attractive format. Google eventually changed the Choice Screen to reflect users top five choices by Member State. However, none of these factors related to the suppression of brands or competition, nor did it rectify the presentation and display’s effects on loss of variety and diversity in supply. Meanwhile, Google’s brand was enhanced from billions of user’s interactions with its products.

Moreover, choice screens have not prevented rival publishers, providers and content creators from being excluded from users’ view by a combination of Apple’s and Google’s actions. This has gone on for decades. Alternative channels for advertising by rival publishers are being squeezed out.

A Better Way Forward

As explained above, Apple helps Google target Apple users with ads and products in return for 36 percent of the ad revenue generated. Prohibiting that RSA would remove the parties’ incentives to reinforce each other’s market positions. Absent its share of Google search ads revenue, Apple may find reasons to build its own search engine or enhance its browser by investing in it in a way that would enable people to shop using the Open Web’s ad funded rivals. Apple may even advertise in competition with Google.

Next, courts should impose (and monitor) a mandatory access regime. Applied here, Google could be required to operate within its monopoly lane and run its relevance engine under public interest duties in “quarantine” on non-discriminatory terms. This proposal has been advanced by former White House advisor Tim Wu:

I guess the phrase I might use is quarantine, is you want to quarantine businesses, I guess, from others. And it’s less of a traditional antitrust kind of remedy, although it, obviously, in the ‘56 consent decree, which was out of an antitrust suit against AT&T, it can be a remedy. And the basic idea of it is, it’s explicitly distributional in its ideas. It wants more players in the ecosystem, in the economy. It’s almost like an ecosystem promoting a device, which is you say, okay, you know, you are the unquestioned master of this particular area of commerce. Maybe we’re talking about Amazon and it’s online shopping and other forms of e-commerce, or Google and search.

If the remedy to search abuse were to provide access to the underlying relevance engine, rivals could present and display products in any order they liked. New SERP businesses could then show relevant results at the top of pages and help consumers find useful information.

Businesses, such as Apple, could get access to Google’s relevance engine and simply provide the most relevant results, unpolluted by Google products. They could alternatively promote their own products and advertise other people’s products differently. End-users would be able to make informed choices based on different SERPs.

In many cases, the restoration of competition in advertising requires increased familiarity with the suppressed brand. Where competing publishers’ brands have been excluded, they must be promoted. Their lack of visibility can be rectified by boosting those harmed into rankings for equivalent periods of time to the duration of their suppression. This is like the remedies used for other forms of publication tort. In successful defamation claims, the offending publisher must publish the full judgment with the same presentation as the offending article and displayed as prominently as the offending article. But the harm here is not to individuals; instead, the harm redounds to alternative publishers and online advertising systems carrying competing ads.

In sum, the proper remedy is one that rectifies the brand damage from suppression and lack of visibility. Remedies need to address this issue and enable publishers to compete with Google as advertising outlets. Identifying a remedy that rectifies the suppression of relevance leads to the conclusion that competition between search-results-page businesses is needed. Competition can only be remedied if access is provided to the Google relevance engine. This is the only way to allow sufficient competitive pressure to reduce ad prices and provide consumer benefits going forward.

The authors are Chair Antitrust practice, Associate, and Paralegal, respectively, of Preiskel & Co LLP. They represent the Movement for an Open Web versus Google and Apple in EU/US and UK cases currently being brought by their respective authorities. They also represent Connexity in its claim against Google for damages and abuse of dominance in Search (Shopping).