I love eggs. I really do. There was a year in law school where I religiously made and ate an egg sandwich for breakfast every day. To this day, I believe an egg fried in olive oil until the yolks are jammy and the edges are crispy is a perfect food.

Since last year, however, my egg-loving style has been cramped. As everyone knows, the price of eggs at the grocery store more than doubled in 2022, increasing from $1.78 a dozen in December 2021 to over $4.25 in December 2022. This 138-percent increase in egg prices far outstripped the 12-percent increase Americans saw in grocery prices generally over the same period. And some Americans have had it much worse, as average egg prices reached well over $6 a dozen in states ranging from Alabama to California and Florida to Nevada.

What’s behind the skyrocketing retail price of the incredible edible egg? Well, for one thing, the skyrocketing wholesale price of that egg. Between January 2022 and December 2022, wholesale egg prices went from 144 cents for a dozen Grade-A large eggs to 503 cents a dozen. This was the highest price ever recorded for wholesale eggs. Over the entire year, wholesale egg prices averaged 282.4 cents per dozen in 2022. When we consider that average retail egg prices for the same year were only about 3 cents higher at 285.7 cents per dozen, it becomes clear that the primary contributor to rising egg prices at the grocery store has been the dramatic increase in the wholesale prices charged by egg producers.

If this gives you hope that relief might be around the corner because you’ve heard something about a recent “collapse” in wholesale egg prices, sadly your hope would be misplaced. Despite this much-ballyhooed collapse, the average wholesale egg price has simply gone from 4-to-5 times what it was in January of last year to 2-to-3 times that number. If that weren’t enough, prices are expected to spike again when egg demand picks up in the run-up to Easter. Ultimately, the USDA is projecting that the average wholesale egg price in 2023 will be 207 cents a dozen—or only about 25% lower than the average price for 2022. So much for a collapse.

Are you wondering who sets these wholesale prices? Why, an oligopoly, of course. The production of eggs in America is dominated by a handful of companies led by Cal-Maine Foods. With nearly 47 million egg-laying hens, Cal-Maine controls approximately 20% of the national egg supply and dwarfs its nearest competitor. The leading firms in the industry have a history of engaging in “cartelistic conspiracies” to limit production, split markets, and increase prices for consumers. In fact, a jury found such a conspiracy existed as recently as 2018, and a wide-ranging lawsuit was brought just a couple of years ago accusing several of the largest egg producers (including Cal-Maine) of colluding to increase prices during the COVID-19 pandemic.

When asked about the multiplying price of their product, these dominant egg producers and their industry association, the American Egg Board, have insisted it’s entirely outside their control; an avian flu outbreak and the rising cost of things like feed and fuel, they say, caused egg prices to rise all on their own in 2022. And, sure enough, those were real headaches for the egg industry last year—about 43 million egg-laying hens were lost due to bird flu through December 2022, and input costs for producers certainly increased over 2021 levels. As my organization, Farm Action, detailed in letters to federal antitrust enforcers last month, however, the math behind those explanations for the steep increase in wholesale egg prices just doesn’t add up.

The reality, we argued, is that wholesale egg prices didn’t triple in 2022, and aren’t projected to stay elevated through 2023, because of “supply chain, ‘act of God’ type stuff,” as one industry executive has tried to spin it. Rather, the true driver of record egg prices has been simple profiteering, and more fundamentally, the anti-competitive market structures that enable the largest egg producers in the country to engage in such profiteering with impunity.

Is it really just profiteering? Yes, it’s really just profiteering.

According to the industry’s leading firms, rising egg prices should be blamed on two things: avian flu and input costs. We can stipulate for the sake of argument that, if a massive amount of egg production and, hence, potential revenue were lost due to avian flu, the largest producers would be justified in trying to recoup some of that lost revenue by raising prices on their remaining sales. Likewise, if there were a sharp rise in egg production costs, we can stipulate that producers would be justified in trying to pass them on to wholesale customers. But was there a nosedive in egg production? Did the cost of egg inputs multiply dramatically? Short answer: No, and No.

The bottom line on the avian flu outbreak is that it simply did not have a substantial effect on egg production. Although about 43 million egg-laying hens were lost due to avian flu in 2022, they weren’t all lost at once, and there were always over 300 million other hens alive and kicking to lay eggs for America. The monthly size of the nation’s flock of egg-laying hens in 2022 was, on average, only 4.8 percent smaller on a year-over-year basis. If that isn’t enough, the effect of losing those hens on production was itself blunted by “record high” lay rates throughout the year, which were, on average, 1.7 percent higher than the lay rate observed between 2017 and 2021. With substantially the same number of hens laying eggs faster than ever, the industry’s total egg production in 2022 was—wait for it—only 2.98 percent lower than it was in 2021.

Turning to input costs, it’s true they were higher in 2022 than in 2021, but they weren’t that much higher. Farm production costs at Cal-Maine Foods—the only egg producer that publishes financial data as a publicly traded company—increased by approximately 20 percent between 2021 and 2022. Their total cost of sales went up by a little over 40 percent. At the same time, Cal-Maine produced roughly the same number of eggs in 2022 as it did in 2021. If we take Cal-Maine Foods as the “bellwether” for the industry’s largest firms, we can be pretty sure that the dominant egg producers didn’t experience anywhere near enough inflation in egg production costs to account for the three-fold increase in wholesale egg prices.

Against the backdrop of these facts, the industry’s narrative simply crumbles. It’s clear that neither rising input costs nor a drop in production due to avian flu has been the primary contributor to skyrocketing egg prices. What has been the primary contributor, you ask? Profits. Lots and lots of profits.

Gross profits at Cal-Maine Foods, for example, increased in lockstep with rising egg prices through every quarter of the last year. They went from nearly $92 million in the quarter ending on February 26, 2022, to approximately $195 million in the quarter ending on May 28, 2022, to more than $217 million in the quarter ending on August 27, 2022, to just under $318 million in the quarter ending on November 26, 2022. The company’s gross margins likewise increased steadily, from a little over 19 percent in the first quarter of 2022 (a 45 percent year-over-year increase) to nearly 40 percent in the last quarter of 2022 (a 345 percent year-over-year increase).

The most telling data point, however, is this: For the 26-week period ending on November 26, 2022—in other words, for the six months following the height of the avian flu outbreak in March and April—Cal-Maine reported a five-fold increase in its gross margin and a ten-fold increase in its gross profits compared to the same period in 2021. Considering the number of eggs Cal-Maine sold during this period was roughly the same in 2022 as it was in 2021, it follows that essentially all of this profit expansion came from—you guessed it—higher prices.

But is this an antitrust problem? Yes, it’s an antitrust problem.

On their own, these numbers plainly show that dominant egg producers have been gouging Americans, using the cover of inflation and avian flu to extract profit margins as high as 40 percent on a dozen loose eggs.

Some agriculture economists and market analysts, however, have questioned whether this price gouging should raise antitrust concerns. The dramatic escalation in egg prices over the past year, they’ve argued, has just been “normal economics” at work. Per Angel Rubio, a senior analyst at the industry’s go-to market research firm, Urner Barry, the runaway increase in wholesale egg prices was simply a function of the “compounding effect” of “avian flu outbreaks month after month after month.” These outbreaks repeatedly disrupted egg deliveries, he presumes, driving customers to assent to spiraling price demands from alternative suppliers. In a blog post on Urner Barry’s website, Mr. Rubio further hypothesized that jittery customers may have “increased their ‘normal’ purchase levels to secure more supply,” goosing up prices even higher.

There are several reasons to doubt this theory of the case. To begin with, Mr. Rubio’s analysis presumes that avian flu outbreaks caused significant disruptions in the supply of eggs even though, as discussed above, the aggregate production data suggests that was not the case. But let’s assume that there were supply disruptions, and that these disruptions did lead to a glut of demand for reliable suppliers, giving them pricing power. If that were the case, it would stand to reason that Cal-Maine—which did not report a single case of avian flu at any of its facilities in 2022—had an opportunity to sell a whole lot more eggs in 2022 than in 2021, and to sell them at record-high profit margins. But Cal-Maine didn’t sell a whole lot more eggs. It sold roughly the same number of eggs. If Mr. Rubio’s theory were right, why did Cal-Maine leave money on the table?

Once we start applying this question to the pricing and production behavior of the egg industry’s dominant firms more broadly, a whole variety of competition red flags start cropping up

The red flags—they multiply!

Let’s talk about pricing first. In a truly competitive market, one would have expected rival egg producers to respond to a near-tripling of average market prices with efforts to undercut Cal-Maine’s skyrocketing profit margin and capture market share. Alas, that did not happen. In researching Farm Action’s letter to antitrust enforcers, we found no evidence of aggressive price competition for business among the largest egg producers. Yet everything about the mechanics of egg sales suggests that they should be competitive. Wholesale customers generally buy their eggs directly from producers. Long-term or exclusive contracts for egg supplies are rare. And the price of eggs in each purchase is individually negotiated. In other words, for each delivery of eggs they need, a wholesale customer is in all likelihood free to shop around and give rival suppliers an opportunity to undercut their incumbent supplier. Given this fluid sales environment, how did Cal-Maine manage to raise prices so much that its profit margin quintupled in one year without any other major producer coming to eat its lunch?

Another head-scratcher has been how the industry has managed to throttle production in the face of sustained high egg prices. As early as August of last year, the USDA was observing that favorable conditions existed, both in terms of moderating input costs and record-high egg prices, for producers to invest in expanding their egg-laying flocks. Yet such investment never materialized.

Even as prices reached unprecedented levels between October and December of last year, the number of eggs in incubators and the number of egg-laying chicks hatched by upstream hatcheries both remained flat, and were even below 2021 levels in December. As the year drew to a close, the USDA observed that “producers—despite the record-high wholesale price—are taking a cautious approach to expanding production in the near term.” The following month, it pared down its table-egg production forecast for the entirety of 2023—while raising its forecast of wholesale egg prices for every quarter of the coming year—on account of “the industry’s [persisting] cautious approach to expanding production.”

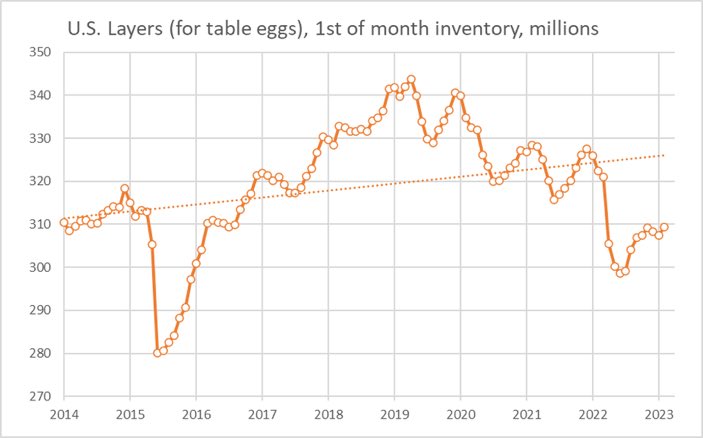

Because of this “caution” among egg producers, the total number of egg-laying hens in the U.S. has recovered from the losses caused by avian flu outbreak of 2022 at less than one-third of the pace it recovered from the (relatively more severe) avian flu outbreak of 2015, according to data from the USDA’s National Agricultural Statistics Service. At its lowest point in the aftermath of the 2022 avian flu outbreak—in June of last year—the egg-laying flock counted a little under 300.5 million hens, or around 30 million (or 9%) fewer hens than it started the year with (330.8 million). For comparison, at its lowest point following the 2015 outbreak—which was also in June of that year—the egg-laying flock totaled 280.2 million and had nearly 35 million (or 11%) fewer hens than it did at the start of 2015 (315 million).

As you can see from the chart above (Fig. 1), in 2015, it took the industry less than 8 months to rebuild the egg-laying flock from its June low point; by the end of February 2016, producers had added over 30 million hens, bringing the total size of the egg-laying flock back up to 310.2 million. Contrast this pace of flock recovery between 2015 and 2016 with the pace of recovery we’ve seen over the past year. In the 8 months that have passed since June of last year, the industry has added less than 9 million hens—leaving the flock at an anemic 309.4 million at the start of February 2023.

On its own, this comparison shows that large egg producers almost certainly could have rebuilt their hen flocks in the wake of last year’s avian flu outbreaks much faster than they have. When considered alongside the fact that, in 2015, the monthly average wholesale price reached its highest point in August and never exceeded $2.71 per dozen, the sluggishness of the 2022-2023 recovery becomes objectively suspicious. According to Urner Barry, in 2015, wholesale egg prices rose 6-8% for every 1% decrease in the number of egg-laying hens caused by the avian flu; that is barely half the 15% price increase for every 1% decrease in hens observed last year. The monthly price for a dozen wholesale eggs in 2022 cleared the 2015 high of $2.71 per dozen as early as April, and stayed at comparable or higher levels through the rest of the year. And yet, egg producers have been “cautiously” adding hens at a third of pace they did in 2015-2016 since June of last year. What gives?

As Senator Elizabeth Warren and Representative Katie Porter noted in recent letters to dominant egg producers seeking answers about ballooning prices, producers appear to be “impervious to the basic laws of supply and demand.” This is the case not only in terms of their willingness to invest in new capacity, but also in terms of their willingness to utilize existing capacity. The rate at which hens lay eggs is the basic measure of flock productivity in the industry. Several factors can affect lay rates, including hen genetics and age, but within physical limits, producers can speed or slow egg-laying by their hens through nutrition, lighting, and other flock management choices. Yet, even as millions of hens were being lost to avian flu and eggs were fetching unprecedented prices last year, producers seemed to make choices that depressed, rather than maximized, their remaining hens’ lay rates.

The average table-egg lay rate reached its highest level ever (around 83.5 eggs per 100 hens per day) in the early, most severe, months of the avian flu epidemic—between March and May of last year—but then it nosedived. By June, the national average lay rate had dropped to about 82.5 eggs per 100 hens per day. This was consistent with seasonal trends in years past; it’s typical for lay rates to moderate as Spring turns to Summer. What happened after June, however, was curious. Normally, the average lay rate would start climbing again in July and stay on an upward trend through the end of the year, with the strongest lay rates often reported in the last 2 or 3 months of the year. In 2022, however, the opposite occurred. Lay rates flat-lined from June through the Fall before dipping to their weakest level in the last three months of the year. In other words, during the exact period when egg prices were hitting their stride—the last six months of 2022—the industry somehow managed to orchestrate a wholesale deviation from historical trends in the direction of getting fewer eggs out of the hens they already had.

If it walks like a cartel and swims like a cartel, maybe it’s a cartel?

Together, these dynamics of throttled production and unrestrained pricing are unmistakable red flags that deserve investigation by enforcers. Take Cal-Maine as an example again. They are the leader in a mostly commoditized industry. They presumably have the most efficient operations and the greatest financial power of any firm in the industry—allowing them to stand up hen capacity as fast as anyone and sell at competitive prices to capture unmet or up-charged demand. Instead of doing that, however, it appears they simultaneously abandoned price competition and refrained from expanding production to satisfy demand last year. This begs the question: What made Cal-Maine so confident that other large producers wouldn’t produce more eggs and undercut its prices? More to the point, why didn’t they?

Whatever the answers to these questions might be, this much is clear: Cal-Maine behaved as if its dominant position were entrenched, and its strategy worked. As rival egg producers have gone along instead of competing on price and production, the industry has been able to sustain elevated egg prices from one year to the next without any legitimate justification. Even as egg prices have started ameliorating this year, the USDA is still forecasting an average wholesale price for 2023 that is 70-to-80% higher than the 2021 average, suggesting that whatever “bottom” egg prices might reach this year will, in all likelihood, be at least an order of magnitude higher than 2021 levels.

This pattern of behavior by dominant egg producers over the past year is consistent with longstanding research beginning in the 1970s—from Blair (1972) to Sherman (1977) to Kelton (1980)—on how leading firms in consolidated industries “administer prices” to achieve higher-margin “focal points” during economic shocks and periods of high inflation. And, make no mistake, the egg industry is consolidated. While the top 10 egg producers control 53%—and Cal-Maine alone controls 20%—of all egg-laying hens in the U.S., these numbers understate concentration in actual egg markets. Smaller egg operations (the ones that control the other 47% of America’s hens) tend to produce specialty, not conventional, eggs for sale at premium price points; as such, they typically have neither the scale nor the capacity to supply national grocery chains with the conventional eggs bought by most consumers. Only the largest egg producers can fill this need—a fact that likely makes the submarket for conventional eggs sold to national customers substantially more concentrated than the total egg supply. Was it pure coincidence that prices barely climbed In the fragmented specialty-egg segment but skyrocketed in the consolidated conventional-egg segment?

The honest answer is that I don’t know. In the end, I’m just a country lawyer with a laptop and a love for fried eggs. But smart people at the Boston Fed, the University of Utah, and a few other places have recently shown—empirically, I’m told—that it’s easier for competitors to coordinate for higher profits during a crisis when their industry is concentrated. Maybe that’s what happened here. Maybe it’s not. The only people who can find out for sure—and get the American people some restitution if it is what happened—are the fine public servants at the Federal Trade Commission, the Justice Department Antitrust Division, and state Attorneys General offices across the country. They should do nothing less.

Conclusion

For nearly 12 months now, dominant egg producers have demonstrated their ability to charge exorbitant prices for a staple we all need for no reason beyond having the power to do it. The “philosophy” of our antitrust laws, as Justice Douglas once reminded his colleagues on the Supreme Court, is that such power “should not exist.” With hundreds of millions of dollars missing from Americans’ pockets to enrich the profits of a handful of robber barons in the egg industry, antitrust enforcers owe the public a duty to investigate, and to see to it that the nation’s laws are enforced—even against entrenched giants.

Basel Musharbash is Legal Counsel at Farm Action, a farmer-led advocacy organization dedicated to building a food and agriculture system that works for everyone rather than a handful of powerful corporations. Basel is also the Managing Attorney of Basel PLLC, a mission-driven law firm in Paris, Texas, focused on the intersection of community development and antitrust law.

Congressional Democrats managed to pass a few crucial measures during December’s lame duck session. One tiny fraction of the omnibus bill to fund the government was the Merger Filing Fee Modernization Act, a measure for which anti-monopoly advocates have long been pushing.

The Act reforms the Hart-Scott-Rodino (HSR) filing fee structure, the program through which the Federal Trade Commission (FTC) and Department of Justice (DOJ) collect fees from corporations seeking to merge and gain federal approval. The HSR program takes significant resources to administer, and the number of companies seeking to merge has increased in recent years — between 2020 and 2021, filing more than doubled from 1,637 to 3,644, but the fee system had not been updated to account for increased burden upon the antitrust enforcers. Due to the Merger Filing Fee Modernization Act increasing the cap on fees, the Congressional Budget Office estimates that the new fees will result in $325 million in each of the first five years, with the two antitrust agencies splitting the fees and receiving $162.5 million each per year.

Congress appropriated $430 million for the FTC and $225 million for the DOJ Antitrust Division for FY2023. These budgets represent only a 22.5% and 11.9% increase from FY2022, respectively, and fall well short of the agencies’ respective requests of $490 million and $273 million. Since 2010, when adjusted for inflation, the FTC has received only a $40 million increase and the Antitrust Division a measly $7 million extra, despite processing more than double the number of HSR transactions in 2022 that they did in 2010. The agencies didn’t request more funding because they’re greedy; they need more funding to carry out their enormous missions, and Congress should support the missions.

The Merger Filing Fee Modernization Act, while an important reform, only increases what share of the FTC and DOJ Antitrust budget comes from HSR fees, and does not increase the overall budget independent of congressional funding. The recent flood of mergers (and higher valuations of those mergers) necessitates additional staff and resources at the agencies to properly review each transaction. Without more investment by Congress, the FTC and DOJ will remain pitifully short-staffed and under-resourced relative to the thousands of mergers and acquisitions that take place each year.

The perpetual underfunding of antitrust regulation has been known for years. As anti-monopoly researcher Matt Stoller pointed out, “spending on antitrust today is about a third what it was throughout most of the 20th century, and with a much bigger economy today. To get back to the level of antitrust enforcement we had in 1941 would require increasing the budgets of the agencies by ten times.”

And beyond the DOJ Antitrust and FTC’s edict to enforce competition, the FTC has another underfunded but crucial mission: consumer protection.

The FTC’s Mission To Protect Consumers Is Just As Important As Protecting Competition

In 2022, the headlines were filled with stories of corporate misdeeds, oftentimes involving deceit of customers. The FTC has a legal mandate and enforcement power to crack down on many such businesses. Through Section 5 of the FTC Act, the FTC can take legal action against companies that engage in “unfair or deceptive acts.”

The FTC has two options for enforcement under Section 5 — administrative and judicial. Administrative enforcement happens after a problem has already arisen. It involves a proceeding in front of an administrative law judge, who issues a cease and desist order if they find a given practice illegal under Section 5. It is then up to the FTC to determine whether the illegal practices warrant additional penalties, mainly through consumer redress or civil fines. Judicial enforcement, on the other hand, is a preventive measure used by the FTC while the administrative process is still underway. For example, the FTC can use judicial enforcement to enjoin a merger that will hurt consumers while the administrative judge is still determining its legality.

One of the FTC’s “top priorities” is to protect older consumers. A 2022 FTC report found that older Americans were more likely to be victims of scams and lost more money when being scammed. The best-known of these are telemarketing scams in which fraudsters convince people to transfer money by impersonating a friend or government agent, or convincing them they’d won a prize or lottery. The fraudsters can’t carry out these schemes alone — and the FTC is cracking down.

FTC Chair Lina Khan has made good on the promise to prioritize cases that harm elderly Americans. In June 2022, the FTC filed a lawsuit against Walmart for its part in facilitating fraudulent transactions that targeted the elderly. The lawsuit alleges that Walmart’s money-transfer service routinely turned a blind eye to fraudulent transactions by not training their employees or warning consumers, thus allowing the scammers to collect the ill-gotten money. Over a five-year period, over 200,000 fraud-induced money transfers were sent to or from Walmart stores, costing consumers nearly $200 million. If the FTC is successful, Walmart will have to compensate consumers for the lost money, pay civil penalties, and be subject to a permanent injunction that forces them to end money-transfering practices that result in fraud.

While older consumers are more likely to fall victim to telemarketing scams, children are unknowingly being tricked by corporations to increase their profits. Epic Games, the video game company that owns Fortnite, was fined $520 million for numerous privacy violations and “deceptive interfaces” that resulted in users, many of whom were children, making unintended purchases.

The FTC also cracked down on so-called “dark patterns” — underhanded tactics that companies use to squeeze more money from consumers including junk fees, misleading advertising, data sharing, and making it difficult to cancel subscriptions. The agency has prosecuted LendingClub, ABCmouse, and Vizio for these dark patterns, and returned millions of dollars to consumers. The public benefits greatly from this work, both by cracking down on shady schemes and putting money back in the victim’s pockets.

Although it carries out work that clearly benefits everyday Americans, the consumer protection side of the FTC often gets less press than high-profile mergers and acquisitions. But Americans are weary of corporations deceiving them to make more money off their private information. According to a 2019 study by Pew Research, 79% of Americans are very or somewhat concerned about how companies are using their personal data. Enforcing laws we already have in place shows people how the Biden Administration can help them by reining in corporate misbehavior and putting money back in their pockets.

In FY 2022, the FTC returned a total of $459.6 million to 2.3 million consumers who lost money to illegal business practices. These are material results demonstrating to people that the government can protect them from corporate shenanigans. And yet, the budget for FY 2023 underfunded the FTC by $60 million. The FTC’s budget request included funds for an additional 148 full-time staff members specifically dedicated to consumer protection, a worthy investment for addressing more of these complaints. Without the full amount of requested funds, it’s unclear how many staffers the FTC will be able to hire, but it certainly will not be enough.

The FTC should make bold requests for adequate staffing, and the Biden Administration should be willing to elevate any resistance from Congress. And don’t just take our word on why such a fight would be good politics – Biden’s prioritizing consumer protection in his State of the Union address demonstrates that he and his team see consumer protection as a political winner.

Going After Dominant Firms Is Not Enough To Protect Consumers

As with antitrust enforcement, the FTC looks to “maximize impact” of its limited resources for enforcing data privacy by going after “dominant” and “intermediary” companies. While this makes the best of the situation, this approach means plenty of abuses are falling through the cracks formed by inadequate funding for enforcement. Compare this to how the Securities and Exchange Commission often targets well-known celebrities when they engage in petty financial fraud — these cases are relatively easy to prosecute and generate headlines that hopefully give the impression of a tough agency on the beat, but these are all ultimately efforts to make do with far too little.

The actions the FTC does take against privacy-violating corporations are isolated and have limited power to deter future misconduct. For example, in 2019, the FTC fined Facebook $5 billion for misleading users by sharing personal information to third parties without their knowledge. While the fine was the largest ever levied by the agency, Facebook was using this misleading tactic for seven years in violation of a 2012 FTC order following previous allegations of even more brazenly deceptive practices.

And it is far from clear if the Trump-era FTC would have taken enforcement action but for the horrendous press Facebook generated for their relationship with Cambridge Analytica. Reliance on high stakes and high stress journalism is not a dependable basis of law enforcement – especially as journalism declines as an industry (ironically, in large part due to abuses by social media platforms). The fact that Facebook, one of the largest companies in the world, got away with deceptive data sharing for seven years also indicates that the FTC needs more resources to go after the dominant firms in addition to ensuring that smaller companies are not engaging in similar tactics. And the $5 billion fine, while historic, was a drop in the bucket for a company that hit a $1 trillion market cap not long after.

The limited financial impact of historic fines would be true for other large corporations profiting off their customer’s information as well. As Marta Tellada of Consumer Reports pointed out, “fines alone will not reform [the] market,” and the tech giants view fines “as a cost of doing business.”

And it’s not just Facebook which collects personal information on its users — today, 73% of companies in the United States do so, from small businesses to monopolies, with many opportunities for corporate malfeasance. When a potentially unfair or deceptive business practice becomes endemic across the economy, regulators cannot meaningfully “set examples” and hope the rest of the market complies. Yes, the FTC needs new rulemaking as well as congressionally-mandated tools for protecting consumers, but ramping up capacity in the meanwhile can tangibly benefit millions of Americans. The FTC needs the resources to properly enforce the laws it is already charged with carrying out.

Andrea Beaty is Research Director at the Revolving Door Project, focusing on anti-monopoly, executive branch ethics and housing policy. KJ Boyle is a research intern with the Revolving Door Project. The Revolving Door Project scrutinizes executive branch appointees to ensure they use their office to serve the broad public interest, rather than to entrench corporate power or seek personal advancement.