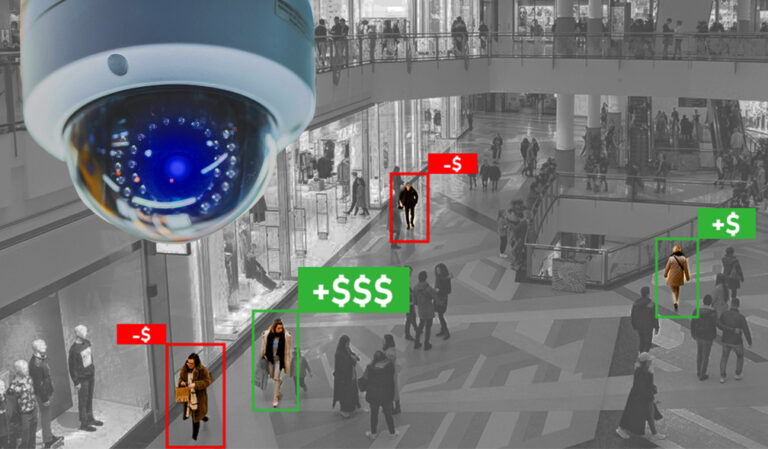

In recent months, public attention has returned to a business practice that many consumers intuitively recognize as unfair and has provoked varying attempts to regulate: surveillance pricing. Investigations into Instacart’s grocery pricing, along with renewed scrutiny of algorithmic pricing by the Federal Trade Commission (FTC), have revived concerns that firms increasingly tailor prices to individual consumers based not on cost or competition, but instead on perceived willingness, or necessity, to pay.

The debate is often framed as a question of technology and fairness: Can algorithms responsibly personalize prices? Do data-driven pricing systems benefit price-sensitive consumers? Are these tools simply the next step in efficient market segmentation?

These questions miss a more fundamental issue of industrial organization. Surveillance pricing is not primarily a technological innovation; it reflects a lack of competition. The profitability, persistence, and coercive nature of surveillance pricing depend on the presence of market failures—especially high concentration, entrenched frictions, and severe information asymmetries. In genuinely competitive markets, surveillance pricing would be unstable and self-defeating. In oligopolistic ones, it becomes a powerful mechanism for extracting consumer surplus.

The rise of surveillance pricing therefore offers a diagnostic insight into modern capitalism: it reveals how concentrated markets transform data and algorithms into tools of consumer exploitation rather than competition.

A Familiar Pattern of Abuse

Surveillance pricing is not new. For more than a decade, journalists and regulators have documented variations of the practice. Ticketmaster’s “dynamic pricing” has transformed concert tickets into auctions that capture nearly all consumer surplus from the most devoted fans. Orbitz infamously offered more expensive hotel options to Mac users, assuming they were less price-sensitive. Staples and Target experimented with GPS-based pricing that charged more to customers situated close to their stores and far from competitors. A ProPublica investigation revealed that Princeton Review charged higher prices to users from ZIP codes with more Asian people.

What unites these examples is not merely personalization, but exploitation. These pricing strategies succeed by identifying moments when consumers are least able to walk away: emergencies, deadlines, emotional commitments, and logistical constraints. The algorithmic sophistication matters less than the underlying logic—using asymmetric information to extract maximum payment from captive demand.

Surveillance pricing relies on exploiting market frictions that are endemic to many modern consumer markets.

Stark information asymmetries mean that sellers now know vastly more about buyers than buyers know about pricing strategies. Firms collect data on browsing history, purchase patterns, location, device type, demographics, mouse movements, and even phone-battery life. Algorithms can infer “need points,” or moments of heightened urgency, such as last-minute flights for the funeral of a family member or late-night ride searches with a dying phone. Consumers, by contrast, have little-to-no visibility into whether a price is individualized, how much it differs from others’ prices, or which data triggered the increase.

Search costs further weaken consumer discipline. Comparing prices once meant driving between stores or walking through malls. Online commerce promised to eliminate these costs, but instead replaced them with digital equivalents: loading multiple sites, navigating opaque interfaces, deciphering bundled products, ascertaining the value of unique features of slightly differentiated offerings, and deciphering subtly differing seller policies through terms and conditions. Each additional click imposes friction that pricing algorithms exploit.

Switching costs compound the problem. Loyalty programs, termination fees, stored payment information, and personalized settings make leaving costly. Consumers must weigh the potential savings from switching against the time and effort already invested in a transaction: accounts created, finance and shipping details entered, digital cart configurations, product configurations, or accrued rewards. Even modest price discrimination can succeed when a consumer feels exhausted by the time, effort, and other sunk costs of conducting market research to make an informed decision to switch.

Learning costs also matter. Choosing a new grocery store requires learning a different aisle layout and where your items are located. A new clothing retailer might have different return policies that burden a customer’s usual practice of trying and returning apparel. In e-commerce, new sellers that a consumer has never heard of may require complex research to distinguish legitimate options from increasingly sophisticated scams that pose a constant threat of financial ruin and require only a single lapse in vigilance and judgment. These cognitive burdens all discourage switching even when alternatives exist.

Product differentiation and bundling further obscure value comparisons. Airlines package seats, bags, boarding priority, and insurance; travel sites bundle flights and hotels; retailers vary sizes, features, and subscription terms. Surveillance pricing thrives in environments where consumers struggle to identify a clear benchmark price.

Finally, in markets like airline tickets, the time gap between purchase and consumption, combined with the difficulty of resale, allows firms to identify inelastic demand. When a product is essential or temporarily critical, like food, last minute transportation, or attendance at an important family event, a customer’s willingness to pay increases dramatically. Algorithms need only detect necessity to capture more consumer surplus.

Why Concentration Is the Key Enabler

Even in a market with the frictions described above, surveillance pricing would be unstable without concentration. In a competitive market, a firm that raises prices for less price-sensitive customers would invite rivals to advertise uniform pricing and capture those consumers. Transparency and rivalry would discipline discriminatory strategies. Even the threat of such competition would deter firms from deploying surveillance pricing at scale.

Oligopolistic markets change the calculus. When a small number of dominant firms control most sales, each can reasonably expect rivals to follow suit rather than defect. The profits from mutual adoption of surveillance pricing outweigh the risk of lost customers when alternatives are limited. Any firm that refuses to participate risks retaliation: price wars with temporary below-cost predatory pricing, increased output, aggressive advertising, complex bundling, or loyalty programs designed to lock in consumers. In concentrated markets, the cost of defection is high, and conscious parallelism becomes the rational equilibrium.

Even in markets with some competitive fringe, dominant firms can deploy partial surveillance pricing. They may offer competitive prices to the most price-sensitive customers while charging inflated prices on niche or low-volume items to less elastic buyers. Or they may use competitive pricing on headline items to shape price perception while extracting surplus elsewhere. The result is higher overall margins without provoking meaningful competition.

At the extreme, a perfectly concentrated oligopoly using surveillance pricing could capture nearly all consumer surplus. In a frictionless, competitive market, the same strategy would drive customers away. Surveillance pricing therefore scales with concentration.

The Illusion of Pro-Consumer Benefits

Defenders of surveillance pricing sometimes argue that it benefits lower-income or more price-sensitive consumers by offering them discounts. This argument collapses under scrutiny.

For surveillance pricing to be profitable, total surplus extraction must increase, otherwise the scheme would be irrational. Discounts for some consumers are outweighed by higher prices for others. In practice, the “discounted” prices approximate what consumers would have paid in a genuinely competitive market, while the inflated prices represent pure extraction from those deemed able—or forced—to pay more.

This is not redistribution; it is maximal surplus extraction. The poorest consumers don’t gain new surplus. Everyone else loses it.

Surveillance pricing has expanded during an era of wage stagnation, declining labor share, rising markups, and elevated corporate profits. These dynamics have steadily reduced household purchasing power and slowed economic growth by suppressing aggregate demand, contributing to a host of social ills related to economic anxiety.

Retail competition once expanded consumer surplus through price matching, coupon honoring, and aggressive rivalry. These strategies once reflected a modicum of buyer power and informational symmetry. Sellers could not individually tailor prices based on personal data; competition disciplined margins.

Surveillance pricing represents a reversal of that equilibrium. It shifts power decisively toward sellers by weaponizing data in markets already tilted by concentration.

Antitrust Law and the Limits of Current Enforcement

While several state and federal legal regimes such as consumer protection, privacy, and anti-discrimination laws offer potential avenues for addressing surveillance pricing (as well as surveillance wage setting) with varying degrees of potential limitations, competition law faces some unique obstacles.

Surveillance pricing sits uneasily within existing antitrust doctrine. It often resembles collusive price-setting, but without explicit agreement. An algorithm or third-party data mining firm that pools competitively sensitive information from multiple competitors to help determine prices could, in theory, constitute an illegal hub in a hub-and-spoke conspiracy under Section 1 of the Sherman Act. But firms could theoretically avoid liability by independently customizing their algorithms and preventing them from using aggregated data from third-party brokers or directly incorporating competitor prices and data. Even independent pricing algorithms could lead to anticompetitive outcomes.

Efforts to prevent algorithmic collusion—such as the California bill banning the use of competitor pricing data—are directionally helpful, but incomplete. Even strictly siloed algorithms could infer market conditions, albeit imperfectly, through demand elasticity tests, purchase rates, cart abandonment, page views, and customer churn rates. Conscious parallelism, or competitors engaging in mutually beneficial common conduct without explicit agreement, remains lawful, and courts have long refused to punish firms for independently adopting strategies that are mutually profitable even when they produce consumer harms identical to cartel price fixing.

As a result, antitrust enforcement alone struggles to address surveillance pricing when it arises from ostensibly lawful parallel conduct rather than explicit price coordination in markets where lax merger enforcement failed to prevent the concentration levels that enable its success.

Mandating Disclosure as Critical First Step

A blanket ban on surveillance pricing would be the most direct solution, but it faces political and legal obstacles. Mandatory disclosure could be a promising first step and is already incorporated in some algorithmic pricing bills and being considered in others. Firms could be required to clearly inform consumers, at the point of sale, that prices may be individualized based on surveillance data. This mirrors the recent FTC rule on junk fees, which forced upfront price disclosure in travel and event markets. Once the entire market was covered, no single firm faced competitive disadvantage for transparency—and many began advertising “what you see is what you pay,” as a consumer-friendly feature.

A disclosure regime would not regulate prices or restrict business autonomy. It would restore informed consent and reduce buyer-side frictions. Ideally, by making discrimination visible, it could reactivate competitive market pressures and be a significant step in curbing its abuse.

A private right of action for violating disclosure could further enhance enforcement, reducing reliance on resource-constrained consumer protection agencies and regulators and allowing harmed consumers to police abuses.

Surveillance Pricing as a Structural Warning Sign

Surveillance pricing should be understood not as an isolated abuse, but as a structural warning sign. It thrives where competition has failed, where consumers lack meaningful alternatives, and where firms can safely exploit moments of vulnerability.

The core question is whether a business strategy that succeeds only by exploiting market failure should be allowed to persist at all. If surveillance pricing is profitable only in oligopolistic markets, then its spread is evidence—not of efficiency—but of the urgent need for stronger competition policy and market transparency.

In that sense, surveillance pricing does more than raise prices. It exposes the costs of having allowed so many markets to reach oligopoly levels of concentration in the first place.

Randy Kim is an assistant city solicitor for Philadelphia and a recent graduate of the University of Pennsylvania’s Carey Law School. The opinions expressed here represent those of the author and not those of his employer.