Google’s August 2024 launch of AI Overviews has reshaped online search and upended the original bargain between publishers and Google. Google places its own AI Overviews at the top of its search results pages, providing the user with a synthesised answer to the query. That answer is provided by Gemini, Google’s large language model (LLM), which has been trained on Google’s search index data supplemented by its FastSearch product to ensure it is up to date. By presenting its own product at the top of the search results pages, Google’s AI Overviews takes up a third of the screen real estate, pushing rival publisher content out of sight and out of mind. Not only are publishers deprived of clicks, AI Overviews takes content from web pages of publishers that are made available on the world wide web for the purpose of being indexed in Google’s search index.

The changes to the search results have dealt a significant blow to news and other publishers, which has grave implications for both media plurality and, by extension, freedom of speech.

Our law firm, which represents the Independent Publishers Alliance, the Movement for an Open Web, and Foxglove Legal (a Community Interest Company), filed complaints with the European Commission (EC) and the UK Competition Markets Authority (CMA) in June 2025 (“The Foxglove cases”).

The complaints identify breaches of EU and UK competition law (abuse of dominance) and a breach of the Digital Markets Act (DMA) in the EU and the Digital Markets Consumers and Competition Act (“DMCCA”) in the UK. They are pleaded on the basis that AI Overviews excludes rivals and discriminates in favor of Google’s own AI-based products while exploiting publishers’ content that is made available for Google’s search index but is simultaneously being used to train Gemini. Publishers have no choice in this new bargain, and if they want to be seen on the web, they are forced to allow Google to use their websites for Gemini’s training. The target of the complaint is to stop Google’s interference with freedom of speech and consumer access to news and other content on the internet.

We are seeking to persuade the EC and CMA to take urgent action, and, if possible, impose interim measures to restrain Alphabet from continuing to use web content for AI Overviews without providing an opt-out for publishers, so they can be found in search without having to train Gemini. Our lawsuit has caught the eye of Reuters, TechSpot, and Antitrust Intelligence, among others.

In September 2025, a similar claim was filed in the United States under U.S. antitrust law for Google’s exclusionary and exploitative practices, accompanying a claim for damages, on behalf of Rolling Stone and other magazines owned by Penske Media.

The Armageddon of News Publishers

The Wall Street Journal dubbed AI Overviews the “AI Armageddon” for online news publishers, and it’s not hard to see why. The combination of (1) diverted traffic from a publisher’s sites, (2) a publisher’s coerced choice to appear in AI Overviews, and (3) Google’s use of a publisher’s content in their AI Overviews from this choice spell a doomsday scenario:

- Websites are provided free of charge to users because they are funded by advertising—either advertising on the website itself (by display ads) or in response to users accepting cookies so that websites can generate a relevant ad. To generate income, websites need traffic from users and clicks on ads. The AI Overviews summaries inherently exclude relevant results from Google results pages and allow users to find answers directly without needing to click on any links. This alteration in search results has increased the rise of the “zero-click” searches or searches that end without clicking on any of the results presented. In the EU, for every 1,000 Google searches, only 374 clicks go to the Open Web. In the United States, the number falls even lower to only 360. The decline in click-through rate for news publishers directly translates into a severe erosion of their online advertising revenue.

- Chrome’s default-setting agreement with Apple and telecoms companies mean Google has over 90 percent of the market for search in the EU and UK. This dominance means news publishers rely on Google to connect their work with readers via the Google search engine result page. As the news organisations’ primary source of online revenue, publishers depend on Google’s display page. In exchange for indexing publisher content, Google is requiring publishers to supply their content for other uses, such as prompting generative AI (“GenAI”) programs to summarize content responsive to user search requests. Google uses a publisher’s content without consent to train its AI models, including its LLMs and the AI assistant product, Gemini. A model of Gemini customized for Google Search then produces AI Overviews and reduces traffic to the same publisher’s websites that it used to train its model.

- AI Overviews both push news publishers down the results page—to make space for Google’s own AI product to cover the results page—whilst also scraping the content of those same publishers to generate summaries using Google’s LLMs. The imbalanced bargaining power has been leveraged by the monopolist leading to a coerced choice: publishers must either surrender control of their content to then feature in AI Overviews or withdraw from Google entirely (sacrificing all search-driven traffic and, for many, their economic viability).

This position is a life-and-death predicament for smaller publishers. While the AI Overview answer is offered at the top of the results page in milliseconds, the work done by news publishers to provide this content can take months (alongside years of professional training) for which they are unpaid. Google is simultaneously exploiting the copyright of news organizations and the labor of their journalists without consequences, and taking part in an unlawful course of what the antitrust recognizes as reciprocal dealing—that is, where company A agrees to buy from company B only if the company B agrees to buy from company A.

Owen Meredith, CEO of the News Media Association, stated Google’s AI Overviews threatens the business model of those who invest in journalism and quality information. This changing landscape is evident in the actions of major publishers that are looking for licensing deals to underpin disappearing revenues, such as the New York Times dealing with Amazon to license its editorial content to train Amazon’s AI platform.

As a result, the availability of different voices and hence media plurality is being eroded by AIOs under the guise of offering a ‘convenient’ summary.

Google Is Becoming a Rival News Publisher

By scraping and repurposing publishers’ content, Google is positioning itself as a rival news publisher, now in direct competition with the organisations that created the journalism its platform distributes. In the United States, slightly more than three percent of trending news queries are now being answered by AIOs, which means that for every 100 trending news queries, more than three are answered solely by AI. To develop into a rival news publisher, Google is expected to have leveraged the algorithms it creates.

Google has been a fierce competitor to news and other publishers for years when it comes to advertising online. Indeed, the essence of the cases brought by the U.S. Department of Justice against Google is the search giant’s inherent “conflict of interest.” Google is a publisher of others’ results as well as its own, and it is a competitor to everyone in online advertising

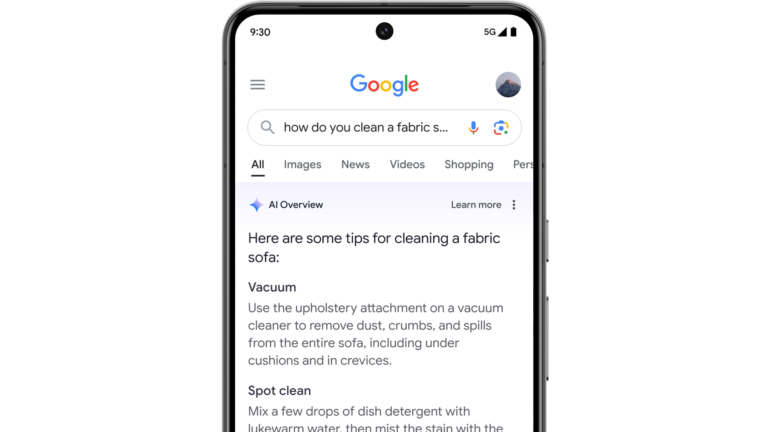

The Mechanics of Google’s AI Overviews

Google’s AI Overviews are increasingly dominating the real estate for searches. The portion of the search results landing page that is visible to a user before ‘scrolling’ is termed as “above the fold.” Since May 2024, AI Overviews has occupied roughly 600 pixels or 100 percent above-the-fold area on a mobile display. And it has occupied 800 pixels or roughly 67 percent of the viewport of the 1,200 pixels available on a standard laptop display.

In other words, AI Overview now appears in a user’s immediate results page for 67 percent of the global browser market. As of March 2025, AI Overviews are triggered by 19 million keywords—a 91 percent rise in the last six months, demonstrating a rapidly accelerating appearance.

The Future Is Not Bright for Publishers

Google is shifting from a search engine to an answer engine. The impact of its transformation of the results page with AI Overviews is not only reshaping how information is presented but also risking permanent changes to consumer behaviour and market dynamics.

Google’s AI Overviews’ anticompetitive effects on publishers are clear. Market forces will not stop Google from swallowing the Internet. Only an intervention by a court can save the news.

Tim Cowen is Antitrust Chair at Preiskel & Co. Abdea Coomarasamy and Uni Valdivieso Wooldridge are Paralegals at Preiskel & Co.